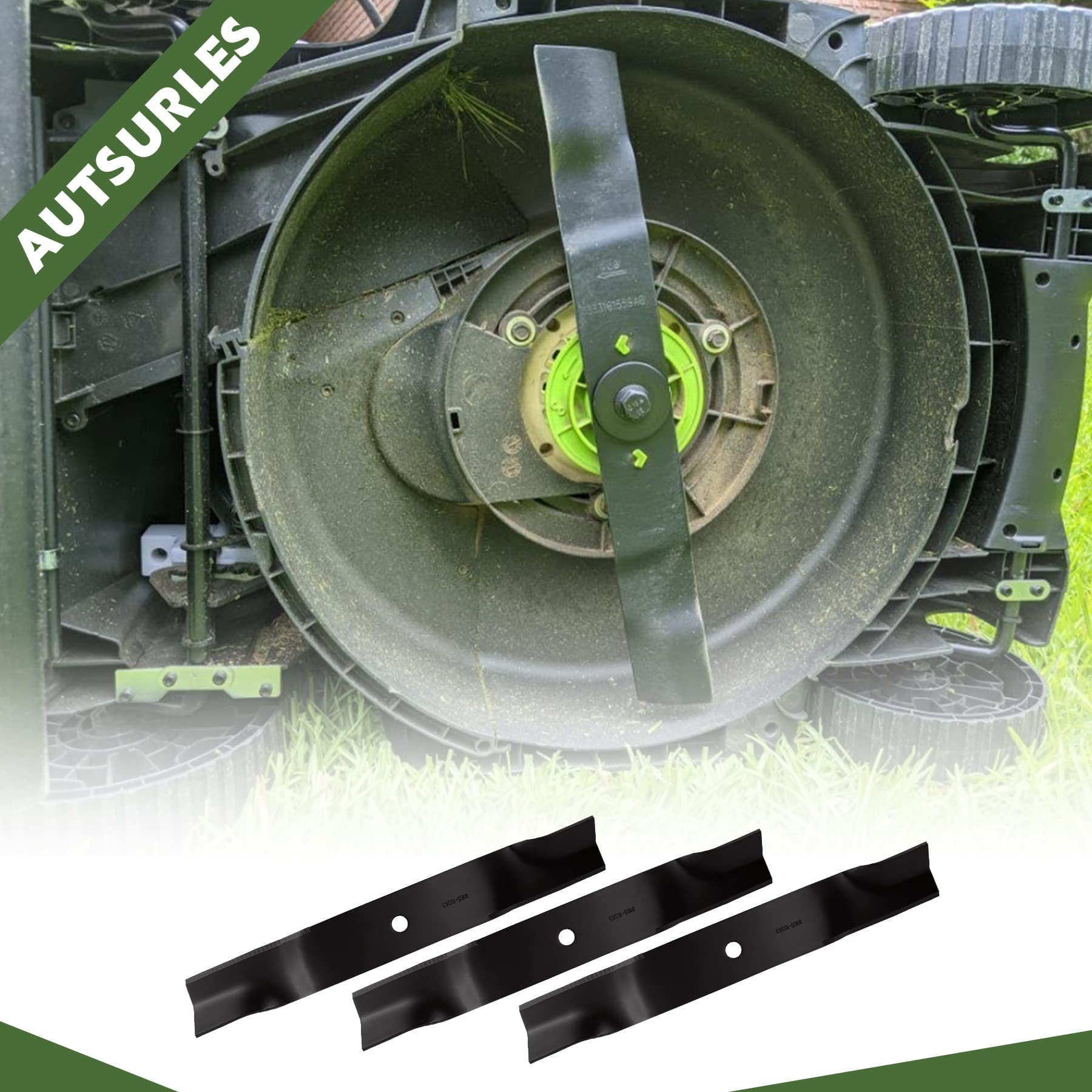

3 Lame Per Tagliaerba Cub Cadet - OEM, Taglio 60", Codici 02005019/1005338/942-04415, Per Modelli Recon M60

Disponibile

Disponibile

€ 21

AGGIUNGI AL CARRELLO

Consegna

- Corriere espressoda venerdì 13 marzoGRATIS

Venduto e spedito da ePRICE

Altri 14 venditori a partire da € 23

- Informazioni legali

- Ne hai uno da vendere?

- 1339319

- 17130197866

Pensati per Te

Prodotti simili

Descrizione

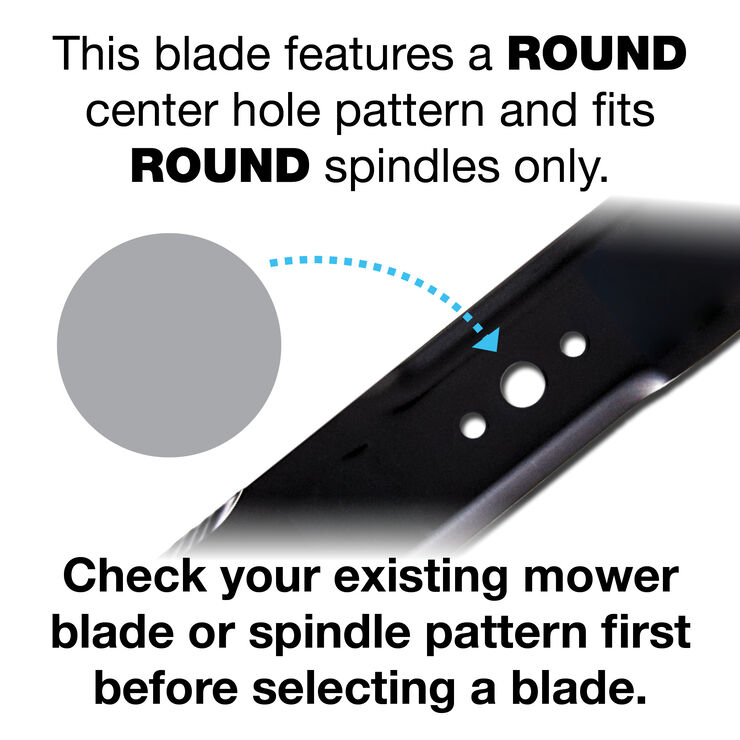

Se il tuo tagliaerba Cub Cadet non taglia più bene, queste lame OEM sono la soluzione! Set da 3, taglio 60\, codici compatibili 02005019, 1005338, 942-04415. Nuove, nella confezione originale, per modelli Recon M60. Ideali per manutenzione ordinaria o sostituzione stagionale. Facili da montare e bilanciate per prestazioni ottimali. Consegna rapida e qualità garantita. Tieni il prato perfetto con ricambi originali!Caratteristiche e scheda tecnica

Caratteristiche principali

- EAN4672037871883

Recensioni

2026-03-07 | muo0u8h