Pompa Bici Lezyne HV Sport Drive - Valvola Auto/Francese, Nuova

Disponibile

Disponibile

€ 13

AGGIUNGI AL CARRELLO

Consegna

- Corriere espressoda mercoledì 11 marzoGRATIS

Venduto e spedito da ePRICE

Altri 16 venditori a partire da € 17

- Informazioni legali

- Ne hai uno da vendere?

- 869623

- 58417327678

Pensati per Te

Prodotti simili

Descrizione

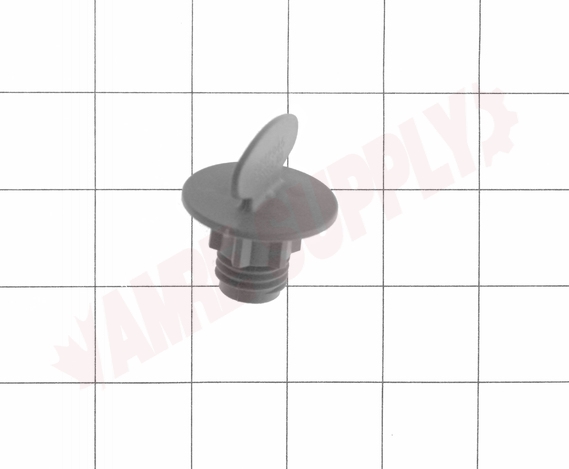

Pompa compatta per bicicletta Lezyne HV Sport Drive, nuova in confezione originale. Funziona con valvole Schrader (auto) e Presta (francese), perfetta per MTB, touring e e-bike. Alta pressione, costruzione robusta in alluminio, colore nero. Facile da portare in giro e da usare. Include gli adattatori necessari. EAN: 4251111561935. Ideale per ciclisti che vogliono una pompa affidabile per le gomme in qualsiasi situazione. Mai usata, pronta all'uso.

Caratteristiche e scheda tecnica

Caratteristiche principali

- EAN9020199459459

Recensioni

2026-03-09 | 1pjqwa0