As the attorneys at Chilivis Grubman have discussed previously, the federal government released a massive wave of funds under the CARES Act in response to the COVID-19 pandemic, including more than $100 billion under the Provider Relief Fund. Providers that have accepted Provider Relief Fund payments must attest to complying with a lengthy list of Terms and Conditions, including an obligation to submit documentation to substantiate that funds were used for healthcare-related expenses or lost revenues attributable to coronavirus.

The Department of Health and Human Services (HHS) has not released any formal rulemaking on the appropriate use of Provider Relief Funds (which would require notice and an opportunity to comment on proposed rules), but rather maintains a webpage of Frequently Asked Questions (FAQs) to provide sub-regulatory guidance. HHS also released a Post-Payment Notice of Reporting Requirements in July 2020 and updated those requirements on January 15, 2021.

On Friday, June 11, 2021, HHS released an updated Post-Payment Notice of Reporting Requirements (Post-Payment Notice) and simultaneously modified several FAQs on the CARES Act Provider Relief Fund. HHS also states that the reporting portal will be open for providers to start submitting information on July 1, 2021.

Post-Payment Notice

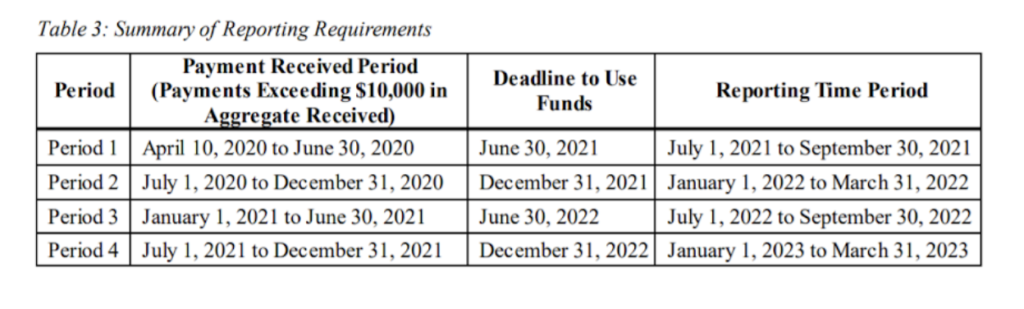

The Post-Payment Notice outlines the data elements that providers who have received Provider Relief Fund Payments (exceeding $10,000 in the aggregate) will be required to report during the applicable “Reporting Time Period.” The Post-Payment Notice’s guidelines are more detailed than prior iterations, and include new tables outlining the deadline for the use of funds and the applicable “Reporting Time Period,” depending on when the Provider Relief Fund Payments were received.

Here’s the summary table:

Notably, it appears that providers may be required to report in each applicable “Reporting Time Period” during which the provider received one or more payments exceeding $10,000 in a “Payment Received Period.” What this practically means is, if a provider received funds both before and on/after July 1, 2020, it may not be able to cumulatively report on all funds received in one single report.

In addition, for Provider Relief Fund payments received during the first two phases of the General Distribution (before July 1, 2020), the deadline for the use of such funds is still June 30, 2021, but the deadline on reporting on the use of such funds has been extended to September 30, 2021.

FAQ General Terms and Conditions Updates

This most recent round of updates to the HHS Provider Relief Fund FAQs include the following general terms and conditions:

1.Is there a set period of time in which providers must use the funds to cover allowable expense or lost revenues attributable to COVID-19?

Response: Yes. HHS notes that Provider Relief Fund recipients must use funds appropriately within a period of 12-18 months, depending on the date the funds were received. HHS refers to the summary chart (included above) to assist with determining the deadline.

HHS also states that recipients may use funds for eligible expenses incurred prior to the date the funds were received, however “it would be highly unusual for providers to have incurred eligible expenses prior to January 1, 2020.”

Of note, HHS has reserved the right to audit Provider Relief Fund recipients “now or in the future” and asserts that it has authority to recoup any Provider Relief Fund amounts that are not supported by “documented expenses or losses attributable to coronavirus or not used in a manner consistent with the program requirements or applicable law.”

2.In order to accept a payment, must the provider have already incurred eligible expenses and losses higher than the Provider Relief Fund payment received?

Response: Per HHS, no. A provider does not have to prove that their losses related to the pandemic meet or exceed their Provider Relief Fund payment at the time the payment is received, but it will be required to report on the use of all received payments (and will be subject to audit).

3.What should providers do if they have remaining Provider Relief Fund money that they cannot expend on permissible expenses or losses by the relevant deadline?

Response: Per HHS, any providers with remaining Provider Relief Fund amounts that cannot be used for permissible expenses or losses by the deadline must return the funds to HHS.

HHS again reiterates that “HHS is authorized to recoup any Provider Relief Fund amounts that were made in error or exceed lost revenue or expenses due to COVID-19, or in cases of noncompliance with the Terms and Conditions.”

HHS also added several new FAQs and modified existing FAQs under the Auditing, Use of Funds, Supporting Data, Change of Ownership, Non-Financial Data, and Miscellaneous subsections.

The attorneys at Chilivis Grubman represent clients of all types and sizes, including healthcare providers and small businesses that have accepted COVID-19 relief funds. If you need assistance with COVID-19 relief funds compliance, please contact us today.