In June, the Centers for Medicare & Medicaid Services (“CMS”) issued a new advisory opinion on whether a physician practice may qualify as a “group practice” for purposes of the federal physician self-referral law (1877(h)(4) of the Social Security Act and 42 C.F.R. § 411.350 et seq., the “Stark Law”), if it furnishes designated health services (“DHS”) through a wholly-owned subsidiary that is a physician practice, but does not itself qualify as a group practice.

The Stark Law prohibits physicians from making referrals for DHS payable by Medicare to an entity with which the physician (or an immediate family member of the physician) has a financial relationship, unless all requirements of an applicable exception are met. The Stark Law is a highly technical, strict liability statute, and violations can open the door to False Claims Act liability.

One key Stark Law exception for physician practices is the In-Office Ancillary Services Exception, which requires a physician practice to meet the definition of a “group practice” (42 C.F.R. § 411.352(a)). Specially, a group practice must consist of a single legal entity operating primarily for the purpose of being a physician group practice.

Facts Presented in the Opinion:

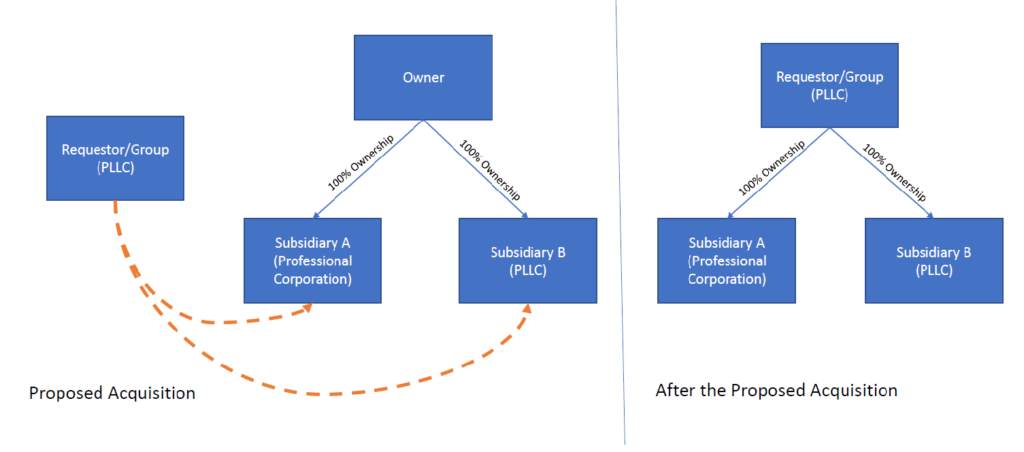

The requestor for the advisory opinion is a physician practice in the form of a professional limited liability company (the “Group”), which asserts that it meets the Stark Law definition of a “group practice.” The Group is considering acquiring two other physician practices from a different owner: (i) Subsidiary A, in the form of a professional corporation, and (ii) Subsidiary B, in the form of a professional limited liability company.

After the proposed acquisition, the Group would be the sole owner of Subsidiary A and Subsidiary B, and would continue providing health services (including DHS) through Subsidiary A and Subsidiary B. All clinical employees and contractors of the Subsidiaries would become employed or contracted by Group, and would be designated to work at either the Group office side, or the office sides for the Subsidiaries. The Subsidiaries would maintain their respective Medicare enrollments, would remain credentialed directly with payors, and would use billing numbers assigned to the Subsidiaries for Medicare and other payors, however all revenues and expenses of the Subsidiaries would be treated as revenues and expenses of the Group.

Key Takeaway:

CMS states that, based on the facts the Group presented in its request for the advisory opinion, the Group may furnish DHS through its wholly-owned Subsidiary A and Subsidiary B while continuing to meet the definition of a “group practice” (including the requirement that the group practice be a single legal entity), even though Subsidiary A and Subsidiary B are physician practices that do not themselves meet the group practice definition. In other words, a group practice may qualify as a single legal entity if the group practice furnishes DHS through its own, wholly-owned subsidiaries.

Limited Scope of Advisory Opinions:

The scope of any CMS advisory opinion is limited to the facts discussed by CMS and certified by the party requesting the opinion. However, CMS’ analysis of the facts can help other healthcare providers identify certain activities that may reduce risk of violating the Stark law in certain types of healthcare business arrangements.

The attorneys at Chilivis Grubman represent clients of all types and sizes in connection with reviewing and negotiating new healthcare business arrangements, including advising on an arrangement’s risks under the Stark Law. If you need assistance with such a matter, please contact us today.